Monitoring investment getting easy with i-account KWSP

I-invest, the newly online investment platform introduced by KWSP has been launched to make member easily monitor their investment fund status offer by approved FMS. For member who has less financing knowledge for fund and investment, i found it very helpful, so at least i can know either the fund really perform well and not just listen from agent 100%. So our monitoring investment getting easy with i-account KWSP anyday, anywhere and anytime.

Simply login to i-akaun using app from your official store or website, and click the investment menu and you will redirect to investment related page.

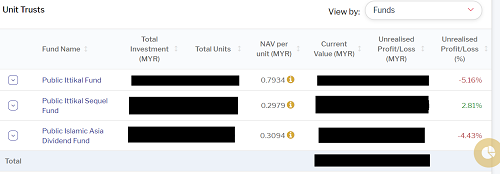

Below are example from my investment fund at Public Mutual, so from here i can know which fund perform well and which fund are losing right now. And how much is losing it also state. Wonderful right. All these listed investment fund are from account 1 withdrawal.

i-invest fund table

Based from official EPF portal, member who below 55 years old also can make investment and the charges are from 0-0.5%. Its 3% charged if we using agent. Lots of difference in term of amount if we do ourselves. Agent will not like it. Hahaha. But of course if we lack of fund knowledge, which fund are perform or which fund are trending. So perhaps we still need agent.

And as per my understand too, we can place investment directly, but for now i’m not able to do it since i already place my investment few months ago and it has recycle period before we can make new investment. Definitely will give a try once able to do it.

But one thing im doubt now is are the unit trust really perform as per agent claim ? Based on my table now looks like its not reallly good even so many years. EPF dividen is better so far. I can get much more. Maybe i need to reconsider this investment again. I need to get more info for this. Perhaps i missing something, wrong fund, or my agent didnt tell me something.

More info for EPF i-invest can be found here from official website : http://www.kwsp.gov.my/-/kwsp-salurkan-rm117-56-bilion-kepada-pengurus-portfolio-luaran

Thats also topic regarding EPF and unit trust here you might interested.