EPF Fund and Public Mutual Fund

Employee Provident Fund

Employee Provident Fund (EPF) or also known as Kumpulan Wang Simpanan Pekerja (KWSP) is a government agency who manages compulsory saving plan and retirement planning for private sector employee.Did you know we can use our EPF in account 1 to invest in registered fund like Public Mutual for example.

This is the cart EPF/KWSP dividend paid since 2000-2015

No. | Year | Dividend Paid |

1 | 2000 | 6.00% |

2 | 2001 | 5.00% |

3 | 2002 | 4.25% |

4 | 2003 | 4.50% |

5 | 2004 | 4.75% |

6 | 2005 | 5.00% |

7 | 2006 | 5.15% |

8 | 2007 | 5.80% |

9 | 2008 | 4.50% |

10 | 2009 | 5.65% |

11 | 2010 | 5.80% |

12 | 2011 | 6.00% |

13 | 2012 | 6.15% |

14 | 2013 | 6.35% |

15 | 2014 | 6.75% |

16 | 2015 | 6.40% |

17 | 2016 | 5.7% |

Dividend paid from 2000-2015

for EPF full dividend paid report, please click here

Public Mutual

Public Mutual is well known as another investment company. Beside public can withdraw from EPF account 1 and invest into Public Mutual. What happen when or if i wanna close account in Public Mutual? Don’t worry, all the money including dividend will going back into EPF account 1.

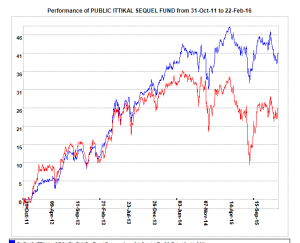

one of fund performance in public mutual

Which one is the best? stay in EPF or withdraw and invest in Public Mutual? Its up to you. Study the market, study the pattern. Which one is the best for you. For me, i’m still hold the magic word ‘Don’t Put All Eggs in A Basket’.

For Public Mutual fund performance full report, please click here to refer

http://www.publicmutual.com.my

Update: now EPF intro new module called i-invest which we can monitor and invest registered fund with FMS directly without agent. Its update everyday so we fund perfomance can be track everyday if we want.So maybe we can make decision are our investment fund really perform well or not . Here are the post you may want to take a look

Suppose that a mutual fund agent approaches you and promote a fund which allows

you to withdraw money from your Employment Provident Fund (EPF) to invest.

From the analysis of the agent, the fund expected to pay up to 11% return, and you

know that EPF paid an average 6% return and treasury’s return fixed at 2.75%. Based

on the discussion in this chapter and in your opinion, are you going to take the

investment?

hi. there are a lot of fund in each investment company . some offer double pay of your total investment when you die, some offer different. ask the agent what benefit every fund will help you. beside there are still good fund out there such as wca or kenanga. just ask the agent and decide which fund suit you and what benefits you really want