LHDN Update and Amend Wrongly Tax Filing

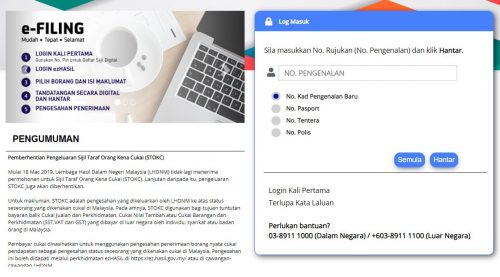

e-filing page

What if one day after submitted tax to LHDN, we suddenly realize we have submitted wrong info either calculation or anything and would like to amend or update or correct it. That what happen to me. Few day after I submitted the form, I realize some of claim made is not right and would like to update and amend the wrongly tax filing.

Do not afraid, all our mistake still can be fix. Here are what I did:

- Call LHDN

- If hotline is busy, call the branch, best if branch where your file is open

- Talk to officer

- Officer will advise what should do, mostly send back all the document to them. Its like audit in advance

Document to Prepare to send to LHDN

- EA form – the most important one

- All the receipt – book, insurance, internet, gadget, zakat, SSPN or anything you want to deduct and claim back

Once all document is submitted to officer, they will do and calculate on our behalf, any final amount will based on the document we send. Final amount might be more or might be less. More info can visit this

That’s all. Now we can relax our mind once all the wrongly submitted tax filing to LHDN mistake is corrected, update or amend .